Does A Failed Credit Card Payment Pull Down Your CIBIL Score?

If you ever wondered whether a single failed credit card payment can pull down your entire credit score, the answer is YES. While a failed payment may be a mistake or the inability to pay (we all go through financial difficulties), lenders view this negatively and it can impact your access to credit in the future. Note that this doesn’t just apply to your credit cards; it holds true for add-on cards, where you’re accountable for others’ spending habits.

Impact on your finances and your CIBIL Score

It helps to know exactly how a single missed payment can affect your finances and your CIBIL Score.

Firstly, always remember that the interest on your missed payments (including the late payment fee) is compounded daily. Monthly interest rates on credit cards can range from 3-4% per month on the outstanding balance (principal, interest and late fees). So, even though you think you missed your payment by a day or a week, your interest liability may be larger than you anticipated. Paying just the minimum due or not paying for a few months will see your amount due balloon significantly.

Let’s take an example of only paying the minimum due for 6 months. On May 1, you make a purchase of Rs. 1,000 on your credit card that has a 3% per month interest rate. You then choose to only make minimum payments due (5% of the outstanding amount at the end of the month) for the next 6 months and spend no additional money on that credit card.

When clearing your balance at the end of 6 months (December), you will end up paying Rs. 1,560 — 56% more than the original amount spent.

| Even without making any more purchases on the card, opting for minimum payments will stretch your repayment period to almost 9 years! | If you choose not to pay minimums, not only will you be delinquent and affect your CIBIL Score, but you will end up paying more than double the amount you had spent. |

This is why it’s critical to read the fine print whenever you avail of a credit card, and it’s even more important to always pay on time.

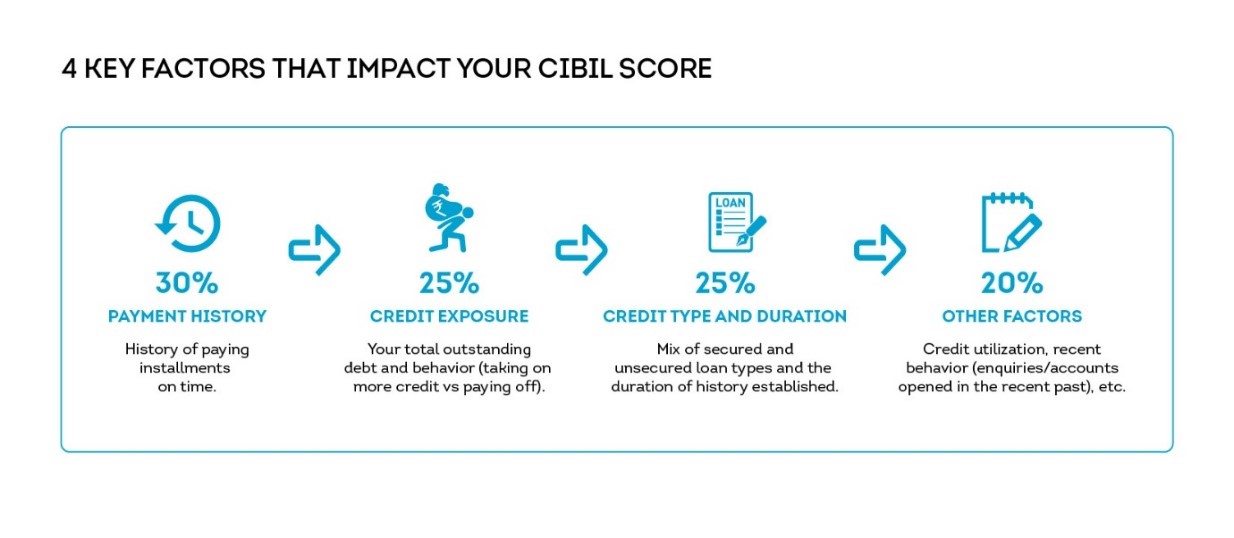

On the other hand, your CIBIL Score is calculated based on the last 24 months of your credit history, and the four major factors that can affect your Score are as follows:

Rebuilding your Score

There are ways to get back on the road to good credit health. Here are two ways to help build your credit score:

- Ensure you clear outstanding dues on credit cards fully. Part-payments or minimum payments indicate difficulties in repaying dues. What’s more, if your amount overdue snowballs it will not only negatively affect your CIBIL Score but you also risk falling into a debt trap. Also, if a pending credit card payment is reported as “Settled” or “Written off”, this will affect your access to credit in the future.

- If you have amounts pending on multiple cards, taking a personal loan at a lower interest rate to pay off your cumulative dues can be an economical option to avoid ballooning debt balances. Alternatively, you can borrow money against your gold, take a loan against your fixed deposit (without breaking it), or even get a loan of 50-80% of your asset value from investments in LIC, mutual funds and securities. The lower interest rate will make for more manageable monthly payments without the problem of an exponentially ballooning debt burden.

While these measures help rebuild your credit health after missed payments, adopting a proactive approach to financial discipline is always more prudent:

- Make sure you always pay on time.

- Don’t take on more debt than you can reasonably afford

Why maintaining a high CIBIL Score is important

A higher score can lead to better loan offers at competitive interest rates primarily because lenders are keen to reward consumers who have demonstrated financial discipline. In addition, emergencies don’t always announce themselves before they arrive and having a high CIBIL Score will ensure that you are able to secure funding quickly (especially in a medical emergency). So, while missed payments can negatively affect your score, regular payments and credit-healthy habits can improve it.

Stay credit-ready by monitoring your CIBIL Score & Report.

Disclaimer: The information posted on this blog (Information) is prepared by TransUnion CIBIL Limited (TU CIBIL). This Information is for generic informational purposes only and is meant for consumer education and awareness about credit scores, credit history and credit reporting. The Information posted on the blog does not constitute credit advice and the user will need to consider the same and take independent informed decisions . No part of this Information may be quoted out of context, distorted ,distributed, published and/ or reproduced in any form and manner whatsoever. Consumers are advised that the Credit Information Reports (CIRs) prepared by TU CIBIL are based on collation of information, substantially, provided by credit institutions who are members with TU CIBIL. TU CIBIL is not responsible and /or liable for errors and/or omissions caused by inaccurate or inadequate information submitted to it by credit institutions. TU CIBIL does not guarantee the adequacy or completeness of the Information and/or its suitability for any specific purpose nor is TU CIBIL responsible for any access or reliance on the Information. TU CIBIL expressly disclaims all such liability. Further, this Information is based on the data available with TU CIBIL at the time of publication and therefore may not be up-to-date.