Loan Rejections and Disputes

My loan has been rejected because of the defaults reported against my name in CIBIL records. How do I remove my name from the CIBIL's defaulters list?

CIBIL doesn’t maintain a defaulters list. We maintain the credit history of individuals as reported by Member Credit Institutions. The decision to grant a loan is solely dependent on the credit policy of the Credit Institution. In order to check your credit history in detail and to identify any possible discrepancies / errors that might be reflecting against your name, you can purchase your CIBIL Score and Report by clicking here.

What kind of inaccuracies can reflect on my CIBIL report?

- Ownership

If either some of the personal details or one or more accounts / enquiries on your CIR do not belong to you.

- Incorrect personal details

Credit Institutions submit details of your credit account along with your personal / contact / employment information such as name, address, date of birth, PAN, telephone number, income etc. CIBIL then creates your complete credit profile basis these details. Hence, it is important to update your Credit Institution every time there is a change in the information as incorrect details may lead to a wrong CIR being generated.

- Inaccurate account details

Credit Institutions generally submit data to CIBIL within a span of 30-45 days and if you happen to purchase your CIBIL Report- within 45 days of your last payment of dues, it may not be updated. This leads to reflection of inaccurate current balance or amount overdue in your CIBIL Report. However, if the ‘Date Reported’ (date on which data is submitted by that lender) associated with that account is older than 2 months, and the payment made is still not reflecting then you can raise a dispute. (click here to view how to raise a dispute).

I have Closed / Paid off the accounts and they are still showing on my report. How do I update my CIBIL report?

As per the Credit Information Companies (Regulation) Act of 2005, CIBIL cannot modify any information in the database without confirmation from the relevant Credit Institution. Credit Institutions submit data every 30-45 days to CIBIL and if you happen to purchase your CIBIL Score and Report within 45 days of closure / pay-off of your accounts it may not be updated in CIBIL records.

Can CIBIL make correction to the data or update / delete any information in the CIBIL Report?

CIBIL cannot make any change directly to your CIBILReport. Only once the change is authorized and provided by the concerned Credit Institution can your CIBIL Report be updated.

I notice a mistake in my report. How do I raise a dispute? How much time will it take to resolve the dispute?

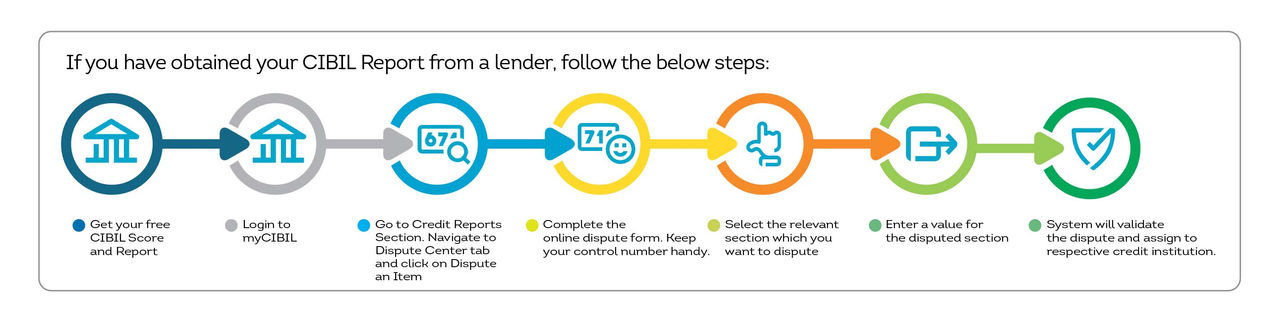

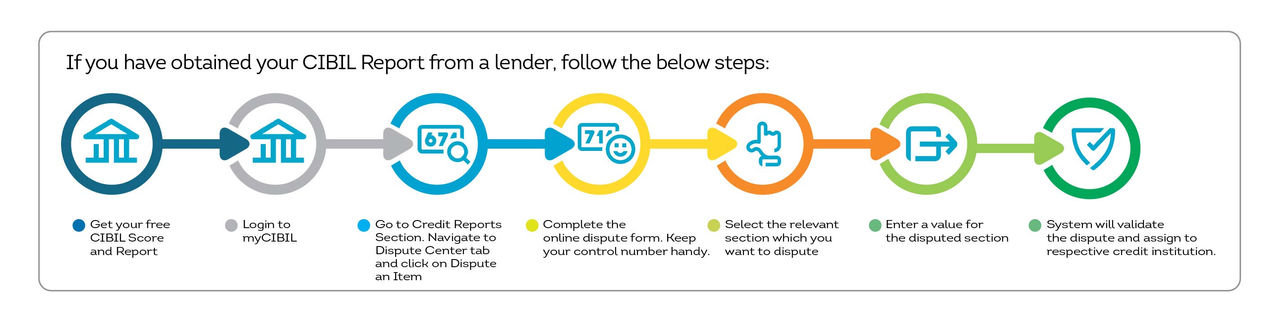

To initiate a dispute with us, just follow the below mentioned online dispute process:

Click this video link to know more.

Please Note –You can dispute multiple fields and information on your report in a single dispute by navigating to each section on the Online Dispute Form (i.e. Personal, Contact, Employment, Account Details and Enquiry).

Received your report from the lender:

Alternatively, you can raise a Dispute Request by writing to us at the following address: TransUnion CIBIL Limited, One Indiabulls Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013

Once you have submitted the dispute, CIBIL will verify the dispute internally and route it to the concerned credit institution. Once the CI responds to the dispute request, CIBIL will update the changes instantly (if applicable), and communicate the status to you via email.

It may take approximately 30 days to resolve a dispute, subject to the time taken by the Credit Institution to respond.

Click Here to understand the Dispute Resolution Process.

My report is incomplete. Can CIBIL add information on my report?

CIBIL cannot add any information directly to your CIBIL Report. The information available on your CIBIL Report is as reported to us by Credit Institutions (CIs). The onus lies with the CIs to report the complete and accurate data to CIBIL. CIBIL’s responsibility lies in accurately updating and accumulating this information across CI’s. Please contact your credit institution to report the missing information to CIBIL.

I am unable to submit a dispute without entering the branch details? What can I do?

Certain banks cannot resolve your dispute unless they have the branch where you have obtained the loan from. Hence, we have automated the process of collecting the branch details from you at the time of initiating the dispute. Providing the branch details will enable the bank route your dispute to the correct branch which will help expediting the dispute process. In case you do not have the branch details, you will need to contact the respective credit institution.

Why can’t I raise more than one dispute type on a particular account / enquiry?

You can either dispute ownership or the fields of an account / enquiry.

If you have disputed the ownership (Account does not belong to you) then disputing other fields is not relevant.

If you are disputing the field for a particular account / enquiry which belongs to you, disputing ownership is not applicable.

What does CIBIL do once I have raised a dispute?

Once you have submitted the dispute, CIBIL will verify the dispute internally and route it to the concerned credit institution. Once the CI responds to the dispute request, CIBIL will update the changes instantly (if applicable), and communicate the status to you via email.

Click here to understand the Dispute Resolution process.

How will I know the status of my dispute?

You will receive an automated email notification regarding the status of your dispute every 7 days.

I had raised a dispute for correcting information on my CIBIL report but I have received a notification that I need to contact my credit institution, Why?

CIBIL cannot make a change to your CIBIL Report until authorized by the Credit Institution. This could either mean that CIBIL cannot update the information basis data provided by the credit institution or the credit institution has rejected your dispute. You will need to contact the concerned Credit Institution (CI) directly for further information or you can initiate a dispute request again and we will re-verify it with the relevant CI.

Why doesn’t CIBIL verify information with consumer before updating the report?

The information available on your CIBIL Report is as reported to CIBIL by Credit Institutions (CIs). The onus lies with the CIs to report the facts accurately to CIBIL. CIBIL’s responsibility lies in accurately updating and accumulating this information across CI’s. In case you find any data inaccuracy in your CIBIL Report you can initiate a dispute resolution process with us and we will get the inaccuracies verified with the concerned CI. Any changes have to be authorized by the concerned CI for it to be updated in CIBIL records to reflect in your CIBIL Report.

What if I’m not satisfied with the results of dispute?

You can choose to contact the concerned Credit Institution (CI) directly. Alternatively, you can initiate a dispute request again and we will re-verify it with the relevant CI. Please note, we cannot make any changes to your CIBIL Report without the confirmation of the respective CI.

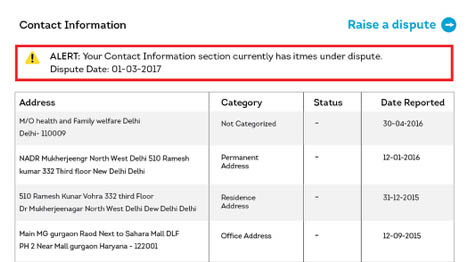

I see the message that certain information on the report is under dispute? What does this mean?

An alert (as highlighted in the below image) indicates that the information in certain sections of your CIBIL Report is disputed. The alert notification will be removed only once the dispute is resolved.

What action will CIBIL take if the CI does not resolve the dispute within 30 days?

CIBIL cannot modify any information in the database without confirmation from the relevant Credit Institution. We have an automated process where a daily reminder will be sent to the bank / CI until the dispute is resolved.

How much time does CIBIL take to update information once the bank has responded to the dispute?

Once we get the corrected data from the Credit Institutions (CI), we update our records instantly.

My account has not been updated for more than 2 months. What should I do?

There could be 2 reasons why your account has not been updated:

- Credit Institution has not submitted your recent data to CIBIL

- There is an ongoing dispute on your account

You can contact your credit institution directly and request them to take appropriate action.

I have approached the CI to update my account details, however I have not received any update?

If you have approached the credit institution directly to update your account in CIBIL records, the onus lies with the CI to send you an update. You can contact your credit institution to know the updated status of your account.